The Envelope System: A Foolproof Budgeting Method

The envelope system is a budgeting method that has been around for decades and has proven to be an effective way to manage personal finances. It involves dividing your income into different categories and allocating a specific amount of cash for each category. You then place the cash into labeled envelopes and use it to pay for expenses in that category throughout the month.

Understanding the envelope system is simple. It is a cash-based budgeting method that allows you to manage your spending by giving you a clear view of how much money you have left in each category. By using cash instead of debit or credit cards, you are more aware of your spending habits and are less likely to overspend. The envelope system can be used for any type of expense, from groceries and entertainment to bills and savings.

Setting up your envelope system is easy. First, you need to determine your monthly income and expenses. Then, you can allocate a specific amount of cash for each category and label an envelope accordingly. You can also use digital tools and apps to manage your envelope system, which can be helpful for tracking your expenses and keeping you on budget.

Key Takeaways

- The envelope system is a cash-based budgeting method that involves dividing your income into different categories and allocating a specific amount of cash for each category.

- The envelope system allows you to manage your spending by giving you a clear view of how much money you have left in each category.

- Setting up your envelope system is easy, and you can use digital tools and apps to manage your expenses and keep you on budget.

Understanding the Envelope System

The Envelope System is a budgeting method that helps us control our spending by dividing our income into different categories and allocating a specific amount of money to each category. This system is based on the principle of assigning a specific amount of cash to each category and keeping it in an envelope. Throughout the month, we can use the cash in each envelope for its specific purpose.

Origins and Principles

The Envelope System was popularized by financial guru Dave Ramsey, who has helped millions of people get out of debt and achieve financial freedom. The system is based on the principle that we should live within our means and avoid debt. By using cash envelopes, we can avoid overspending and keep our finances in check.

Physical vs. Virtual Envelopes

Traditionally, the Envelope System involves using physical envelopes to store cash for each category. However, in today’s digital age, there are also virtual envelope systems such as Mvelopes and Goodbudget. These apps allow us to create virtual envelopes and allocate funds to each category. While physical envelopes can be more tangible and help us visually see our spending, virtual envelopes offer convenience and accessibility.

In summary, the Envelope System is a simple yet effective budgeting method that can help us stay on track with our finances. By assigning a specific amount of cash to each category and keeping it in an envelope, we can avoid overspending and achieve our financial goals. Whether we choose to use physical envelopes or virtual envelopes, the key is to stick to our budget and live within our means.

Setting Up Your Envelope System

If you’re new to the envelope budgeting system, you may be wondering how to get started. Here are some steps to help you set up your system:

Determining Budget Categories

The first step in setting up your envelope system is to determine your budget categories. This involves identifying all of your regular expenses, such as rent/mortgage, utilities, groceries, transportation, entertainment, and so on. You can also include irregular expenses, such as car repairs, medical bills, and gifts.

Once you have identified your budget categories, you can then decide how much money to allocate to each category. This will depend on your after-tax income and your financial goals. It’s important to be realistic and to create a zero-based budget, which means that every dollar is accounted for.

Allocating Income to Envelopes

After you have determined your budget categories and how much money to allocate to each, the next step is to allocate your income to envelopes. You can use physical envelopes or digital envelopes, depending on your preference.

For physical envelopes, simply label each envelope with the appropriate category and place the allocated cash inside. For digital envelopes, you can use budgeting apps that allow you to create virtual envelopes and allocate funds accordingly.

It’s important to review your envelopes regularly to ensure that you are staying within your budget and making progress towards your financial goals. If you find that you are consistently overspending in a particular category, you may need to adjust your budget or find ways to reduce your expenses.

By following these steps, you can set up an envelope system that works for you and helps you achieve financial success.

Managing Expenses with Envelopes

At its core, the envelope system is a budgeting method that helps us control our expenses by dividing our money into different categories and putting cash into envelopes for each category. This method is particularly helpful for people who struggle with overspending, impulse buying or those who need a visual reminder of their budget.

Controlling Variable Expenses

Variable expenses are the costs that can fluctuate from month to month, such as groceries, entertainment, and clothing. These costs can add up quickly and can be difficult to control. However, by using the envelope system, we can set a budget for each category, and once the money in the envelope runs out, we can’t spend any more in that category until the next month.

To make sure we don’t overspend, we should keep track of our spending by writing down every purchase on the envelope or in a notebook. We can also save money by using coupons, buying generic brands, and meal planning.

Handling Fixed Expenses

Fixed expenses are the costs that remain the same each month, such as rent, mortgage, car payments, and insurance. These expenses can be easier to manage since we know the exact amount we need to pay each month. To handle fixed expenses with the envelope system, we can set aside the money we need for each bill in a separate envelope.

By doing this, we can ensure that we have enough money to pay our bills on time and avoid late fees or penalties. It’s also a good idea to set up automatic payments for fixed expenses to avoid forgetting to pay a bill.

Dealing with Unexpected Costs

Even with a well-planned budget, unexpected costs can come up. This is where having an emergency fund comes in handy. An emergency fund is a separate envelope or savings account that we set aside for unexpected expenses such as car repairs, medical bills, or home repairs.

We should aim to save at least three to six months’ worth of living expenses in our emergency fund. By having this buffer, we can avoid going into debt or dipping into our other envelopes to cover unexpected costs.

In conclusion, the envelope system is an effective way to manage our money and control our expenses. By dividing our money into different categories and using cash envelopes, we can avoid overspending, save money, and achieve our financial goals.

Advantages of the Envelope Budgeting Method

The Envelope System is a budgeting method that involves allocating your income into different categories and putting the cash into envelopes labeled with each category. This method is gaining popularity because it is an effective way to manage your finances and control your spending. In this section, we will discuss the advantages of the Envelope Budgeting Method.

Preventing Overspending

One of the advantages of the Envelope System is that it helps prevent overspending. By allocating a specific amount of cash to each envelope, you are limiting your spending to the amount of cash in that envelope. This helps you avoid overspending and keeps you accountable for your spending.

Building Savings and Debt Repayment

Another advantage of the Envelope System is that it helps you build savings and pay off debt. By allocating a portion of your income to a savings envelope, you are setting aside money for emergencies or future expenses. Additionally, by allocating a portion of your income to a debt repayment envelope, you are making progress towards paying off your debts.

Enhancing Money Management Skills

The Envelope System also helps enhance your money management skills. By using cash instead of credit cards, you are more aware of your spending habits and can make better financial decisions. Additionally, by tracking your spending and monitoring your envelopes, you can identify areas where you may need to adjust your budget.

Overall, the Envelope System is an effective way to manage your finances, control your spending, build savings, and pay off debt. By using this method, we can enhance our money management skills and achieve greater financial stability.

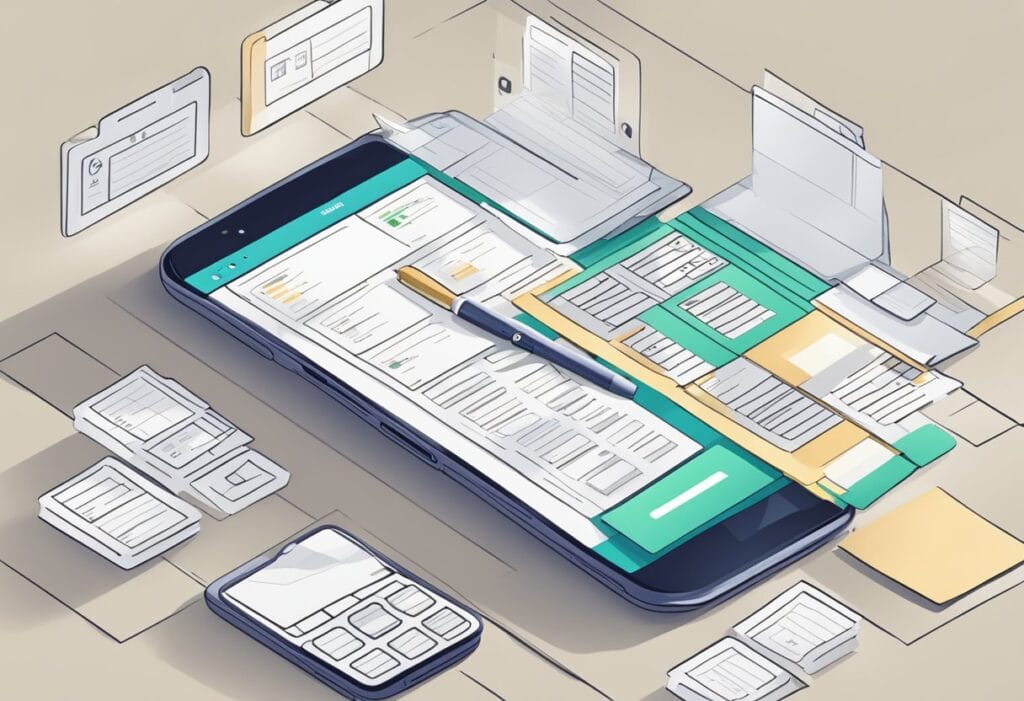

Digital Tools and Apps for Envelope Budgeting

When it comes to envelope budgeting, there are a variety of digital tools and apps available to help you manage your finances more effectively. These tools can be especially helpful if you prefer to manage your budget electronically rather than with physical envelopes.

Budgeting Software and Apps

One popular option for digital envelope budgeting is budgeting software and apps. These programs allow you to create a budget and allocate funds to different categories, just like with physical envelopes. Some examples of budgeting software and apps include:

- Goodbudget: This app uses the principles of the envelope method but eliminates the physical envelopes. Instead of using cash, Goodbudget allows users to link their bank accounts to the app.

- YNAB: YNAB stands for “You Need A Budget,” and it’s a popular budgeting app that helps users track their spending and create a budget that works for them.

- Mvelopes: This app is designed specifically for digital envelope budgeting, and it allows users to create envelopes for different categories and track their spending in real-time.

Integrating with Bank Accounts

Another option for digital envelope budgeting is to integrate your budgeting app with your bank accounts. This can help you keep track of your spending more easily and make sure that you’re staying within your budget.

Many budgeting apps allow you to link your bank accounts directly to the app, so you can see your transactions and balances in real-time. Some apps even offer automatic categorization of your expenses, so you don’t have to manually assign each transaction to an envelope.

Overall, there are many digital tools and apps available to help you with envelope budgeting. Whether you prefer to use an app or budgeting software, or you want to integrate your budgeting with your bank accounts, there’s a solution out there that can help you manage your finances more effectively.

Challenges and Solutions in Envelope Budgeting

Envelope budgeting can be a powerful tool for managing finances, but it’s not without its challenges. In this section, we’ll explore some common pitfalls and how to avoid them, as well as how to adapt the system to personal needs.

Common Pitfalls and How to Avoid Them

One common pitfall of envelope budgeting is failing to stick to the system. We may start out strong, but over time, it can be easy to slip back into old spending habits. To avoid this, it’s important to set clear goals and commit to the system. We can remind ourselves of our goals by keeping them visible, such as on a bulletin board or in a notebook.

Another challenge is deciding on spending categories. It can be difficult to know how much to allocate for each category, especially if our spending habits fluctuate from month to month. To overcome this, it can be helpful to track our spending for a few months to get an idea of where our money is going. From there, we can adjust our categories as needed.

Finally, it’s important to be flexible with the system. Life happens, and unexpected expenses can throw a wrench in our plans. Rather than giving up on the system altogether, we can adapt it to our needs. For example, if we have an unexpected medical expense, we may need to pull money from another category to cover it.

Adapting the System to Personal Needs

The envelope system is highly customizable, which makes it a great option for a variety of people and situations. Some people may find it helpful to have separate envelopes for each spending category, while others may prefer to use a digital tool to track their spending.

Additionally, the system can be adapted to fit different goals. For example, if our goal is to save for a down payment on a house, we may allocate more money to our savings envelope each month. If our goal is to pay off debt, we may focus on allocating more money to debt payments.

Overall, the envelope system can be a powerful tool for managing finances. By setting clear goals, committing to the system, and being flexible, we can overcome common challenges and adapt the system to fit our personal needs.