Master Your Money Moves: A Hilarious Guide on How to Create and Stick to a Budget

Are you grappling with the idea of how to create and stick to a budget without it feeling like a Herculean task or, worse, a snooze fest? Fear not, financial warriors! This isn’t your grandma’s dusty ledger or a monotonous spreadsheet saga. Welcome to “Budgeting 101,” where we’ll transform your money management skills from hapless to heroic, all with a pinch of humor and a dollop of practical wisdom.

Imagine embarking on a thrilling quest, one where every dollar is a loyal soldier in your army, marching towards the fortress of financial freedom. We’ll arm you with a treasure map to navigate the perilous pitfalls of unnecessary spending and the dark forest of impulse buys. With our trusty guide, you’ll learn to wield the mighty sword of savvy spending and shield yourself with the armor of astute savings.

So, buckle up, budgeteers! Prepare to embark on an epic journey through the mystical land of personal finance. By the end of this post, you’ll not only know how to create and stick to a budget, but you’ll do so with the finesse of a financial ninja and the wisdom of a money sage. Let’s dive into the belly of the beast and emerge victorious, with wallets intact and bank accounts burgeoning!

Creating and sticking to a budget is an essential skill that everyone should possess. It helps us manage our finances effectively, avoid debt, and achieve our financial goals. However, budgeting can be challenging, especially if you’re new to it. In this article, we’ll show you how to create and stick to a budget, step by step.

Overview

First, we’ll cover the basics of budgeting, including why it’s important, what a budget is, and how to set financial goals. Then, we’ll walk you through the process of creating a budget, from tracking your income and expenses to identifying areas where you can cut back. Finally, we’ll provide you with tips and strategies to help you stick to your budget, even when it gets tough.

By the end of this article, you’ll have a clear understanding of how to create and stick to a budget, and you’ll be ready to take control of your finances. So, let’s get started!

Understanding Your Finances

As we begin our journey towards creating and sticking to a budget, it’s important to first understand our finances. This means taking a closer look at our income, expenses, and financial goals. By doing so, we can gain a better understanding of our financial situation and make informed decisions about how to manage our money.

Assessing Income and Employment

The first step in understanding our finances is to assess our income. This includes not only our paycheck, but any additional sources of income we may have, such as rental income or freelance work. It’s important to take a look at our net income, which is the amount of money we take home after taxes and other deductions.

We should also take a closer look at our employment situation. Are we working full-time or part-time? Do we have job security or are we at risk of losing our job? Understanding our employment situation can help us plan for the future and make informed decisions about our finances.

Tracking Spending and Expenses

Once we have a clear understanding of our income, it’s important to track our spending and expenses. This includes everything from bills and groceries to entertainment and travel expenses. By tracking our expenses, we can identify areas where we may be overspending and make adjustments to our budget accordingly.

There are many tools available to help us track our expenses, including budgeting apps and spreadsheets. It’s important to find a method that works for us and stick to it consistently.

Setting Financial Goals

Finally, it’s important to set financial goals for ourselves. This may include saving for a down payment on a house, paying off debt, or building an emergency fund. By setting clear financial goals, we can create a roadmap for our finances and stay motivated to stick to our budget.

When setting financial goals, it’s important to be realistic and specific. We should break our goals down into smaller, achievable steps and track our progress along the way.

In summary, understanding our finances is a crucial first step towards creating and sticking to a budget. By assessing our income and employment situation, tracking our spending and expenses, and setting clear financial goals, we can gain a better understanding of our financial situation and make informed decisions about how to manage our money.

Creating a Realistic Budget

When it comes to creating a budget, it’s important to make sure it’s realistic and tailored to your needs. Here are some steps we can take to create a budget that works for us.

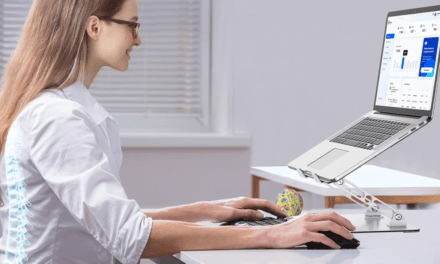

Choosing the Right Budgeting Tool

There are many budgeting tools available, such as budgeting apps and spreadsheets. It’s important to choose the right tool that works for us. Some budgeting apps allow us to track our expenses and income automatically, while others require manual input. On the other hand, spreadsheets offer more flexibility and customization options. We should choose a tool that we feel comfortable using and that fits our lifestyle.

Allocating Funds to Essentials

When creating a budget, we should first allocate funds to our essentials, such as housing, food, transportation, and utilities. These are needs that we can’t live without, so it’s important to prioritize them. We should take a look at our income and expenses and make sure we’re allocating enough funds to cover these essentials.

Planning for Non-Essential Items

While essentials should be our priority, it’s also important to plan for non-essential items, such as entertainment and hobbies. We should allocate a portion of our income to these items, but make sure we’re not overspending. One way to do this is by using the envelope system, where we allocate a certain amount of cash to each category and only spend what’s in the envelope.

Overall, creating a realistic budget takes time and effort, but it’s worth it in the long run. By prioritizing our essentials and planning for non-essential items, we can ensure that we’re living within our means and achieving our financial goals.

Strategies for Saving and Debt Repayment

Establishing an Emergency Fund

One of the most important steps in creating a budget is establishing an emergency fund. This fund should ideally contain enough money to cover three to six months’ worth of living expenses. We recommend setting up an automatic transfer to a separate savings account each month to build up this fund over time. It’s important to prioritize this fund over other savings goals, as unexpected expenses can arise at any time.

Prioritizing Debts

When it comes to debt repayment, it’s important to prioritize which debts to pay off first. We recommend focusing on high-interest debts, such as credit card debt, before moving on to lower-interest debts like student loans. One effective strategy is the debt snowball method, where you pay off the smallest debt first and then roll that payment into the next smallest debt, creating momentum as you go.

Setting Savings Goals

In addition to establishing an emergency fund, it’s important to set specific savings goals. This could include saving for a down payment on a house, contributing to a retirement account, or simply building up a general savings fund. We recommend setting SMART goals – specific, measurable, achievable, relevant, and time-bound – to ensure that you stay on track and make progress towards your goals.

Overall, by following these strategies for saving and debt repayment, we can create a budget that allows us to achieve our financial goals and build a more secure financial future.

Managing Monthly Expenses

When creating a budget, it’s important to take into account all of our monthly expenses. By doing so, we can get a better understanding of where our money is going and where we can cut back. In this section, we’ll discuss how to manage our monthly expenses effectively.

Handling Housing and Utilities

Housing and utilities are usually our largest monthly expenses. When creating a budget, we should allocate a set amount for rent or mortgage payments, as well as utilities such as electricity, water, and gas. It’s important to keep in mind that these expenses can vary from month to month, so we should always aim to have a buffer in case of unexpected costs.

To save money on housing, we can consider downsizing or finding a roommate. We can also negotiate with our landlord for a lower rent or look for a cheaper place to live. When it comes to utilities, we can save money by being mindful of our usage and finding ways to reduce our consumption, such as turning off lights when we’re not in the room or using energy-efficient appliances.

Budgeting for Food and Groceries

Food and groceries are another significant monthly expense. To manage these expenses, we can create a grocery list and stick to it, buy in bulk when possible, and avoid eating out excessively. We should also consider meal planning and cooking at home, as this can save us a lot of money in the long run.

When creating a budget for food and groceries, we should take into account our dietary needs and preferences, as well as any upcoming events or holidays that may require additional spending. We can also look for deals and coupons to save money on our grocery shopping.

Controlling Discretionary Spending

Discretionary spending includes expenses such as entertainment, dining out, travel, and transportation. While it’s important to have some discretionary spending in our budget, we should be mindful of how much we’re spending in these categories.

To control our discretionary spending, we can set a limit for each category and track our expenses carefully. We can also look for ways to save money, such as using public transportation instead of driving or finding free or low-cost entertainment options.

By managing our monthly expenses effectively, we can create a budget that works for us and stick to it. This can help us achieve our financial goals and improve our overall financial well-being.

Adjusting Your Budget Over Time

As we continue to track our progress towards our financial goals, it’s important to review and adjust our budget on a regular basis. Life is full of unexpected changes, and our budget should be flexible enough to adapt to these changes. In this section, we’ll discuss some tips for adjusting your budget over time.

Reviewing and Adjusting Monthly

One of the best ways to stay on track with your budget is to review and adjust it on a monthly basis. This allows you to see how you’re progressing towards your financial goals and make any necessary adjustments. Start by reviewing your spending from the previous month and comparing it to your budget. If you overspent in a certain category, consider adjusting your spending limit for that category in the upcoming month. If you underspent in a certain category, you may be able to decrease your spending limit in that category and allocate those funds elsewhere.

Dealing with Financial Changes

Life is full of financial changes, such as changes in employment, interest rates, taxes, and insurance. When these changes occur, it’s important to adjust your budget accordingly. For example, if you receive a raise at work, you may want to increase your savings goals or allocate more funds towards debt repayment. On the other hand, if you experience a decrease in income, you may need to decrease your spending limits in certain categories or find ways to increase your income.

Staying Flexible with Spending Limits

While it’s important to have spending limits in place, it’s also important to stay flexible with those limits. For example, if you have a spending limit of $100 per month on dining out, but you have a special occasion coming up, it may be okay to exceed that limit for that month. However, it’s important to make sure you’re not consistently exceeding your spending limits, as this can lead to overspending and make it difficult to reach your financial goals.

In conclusion, adjusting your budget over time is an important part of creating and sticking to a budget. By reviewing and adjusting your budget on a regular basis, dealing with financial changes, and staying flexible with your spending limits, you can stay on track towards your financial goals.

Frequently Asked Questions

What are the most effective strategies for adhering to a personal budget?

The most effective strategies for adhering to a personal budget include setting realistic goals, tracking your expenses, and creating a budget that fits your lifestyle. It’s important to be disciplined and avoid overspending, but also to allow yourself some flexibility and adjust your budget as needed.

How can someone with a low income effectively manage their finances through budgeting?

Managing finances on a low income can be challenging, but it’s not impossible. Some effective strategies include prioritizing expenses, finding ways to increase income, and reducing unnecessary expenses. It’s also important to take advantage of resources like financial education classes and budgeting apps.

Can you explain the 50/20/30 rule for budgeting?

The 50/20/30 rule is a popular budgeting method that suggests allocating 50% of your income to necessities, 20% to savings and debt repayment, and 30% to discretionary spending. This rule can be a helpful starting point, but it’s important to adjust it based on your personal circumstances and goals.

Why might someone have difficulty maintaining a budget and how can they overcome this challenge?

Difficulty maintaining a budget can stem from a variety of factors, including lack of discipline, unexpected expenses, and unrealistic expectations. To overcome this challenge, it’s important to identify the root cause and make adjustments accordingly. This might involve seeking support from a financial advisor or accountability partner, or finding new ways to motivate yourself to stick to your budget.

What are the best tools for creating a personal budget plan?

There are many tools available for creating a personal budget plan, including budgeting apps, spreadsheets, and financial planning software. The best tool for you will depend on your personal preferences and needs. Some popular options include Mint, YNAB, and Personal Capital.

Final Thoughts On How To Create And Stick To A Budget

And there you have it, intrepid budgeteers, a veritable cornucopia of tips and tricks on how to create and stick to a budget with the grace of a gazelle leaping over financial hurdles. You’ve journeyed through the wilds of wise spending, forded the streams of savings, and climbed the mountains of monetary mastery. Now, you stand at the peak, gazing over the land of fiscal responsibility that lies before you.

As we draw the curtains on this financial theater, remember that your budget is a living, breathing blueprint for your economic success. It’s not carved in stone; it’s sketched in the sands of change, ready for you to redraw as life throws its curveballs and confetti at you. Embrace the ebb and flow of your finances with the confidence of a captain sailing the ever-shifting seas.

Don your budgeting cape and soar into the skies of solvency, my friends. May your pockets be heavy with saved coins, your debts as light as a feather, and your financial future as bright as a supernova in a galaxy of prosperity. Until our next fiscal adventure, keep your ledger close, your calculator closer, and your sense of humor at the ready. Happy budgeting!