Prioritizing Expenses Like a Pro: The Hilarious Guide to Stretching Your Dollars

Prioritizing expenses might just be the superhero skill you never knew you needed, donning its cape every time you peek at your bank account with a mix of hope and horror. In the epic saga of your financial life, where ‘Savings’ and ‘Splurge’ often battle for dominance, a foolproof guide to budgeting emerges as the trusty sidekick, ready to swoop in and save the day. Welcome to our blog post, where we’ll transform you from a spender to a saver faster than you can say “zero balance.”

Now, let’s be honest, budgeting can sometimes feel like trying to solve a Rubik’s Cube—blindfolded. But fear not! We’re here to demystify the art of managing moolah with a sprinkle of humor and a whole lot of practical wisdom. Imagine this: your expenses lined up like ducks in a row, each waiting patiently for their turn to waddle out of your wallet. Sounds peaceful, doesn’t it? That’s because it is, and it’s entirely achievable.

In this medium-sized slice of financial wisdom, we’ll guide you through the labyrinth of ledgers and the pandemonium of paychecks. You’ll learn to navigate the treacherous waters of unexpected costs with the grace of a dolphin and the cunning of a fox. And trust us, by the end of this read, you’ll be more prepared to tackle your budget than a cat is to pounce on a red laser dot—focused, determined, and with an impressive success rate.

So, buckle up, dear reader. You’re about to embark on a thrilling journey to the land of fiscal responsibility, where ‘Prioritizing Expenses’ is not just a catchy blog post title, but a way of life. Let the budgeting bonanza begin!

Overview

Prioritizing expenses is a crucial step in managing our finances. Whether we have a limited income or not, it is essential to ensure that our spending aligns with our financial goals. By prioritizing our expenses, we can make sure that we are spending our money on the things that matter most to us.

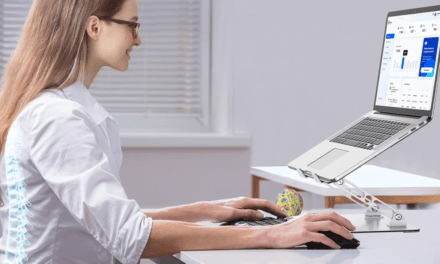

To prioritize our expenses effectively, we need to start by creating a budget. A budget is a plan that outlines our expected income and expenses over a specific period. It allows us to see where our money is going and identify areas where we can cut back. By creating a budget, we can also set aside money for our financial goals, such as saving for a down payment on a house or paying off debt.

Once we have a budget in place, we can start prioritizing our expenses. This means deciding which expenses are essential and which ones are discretionary. Essential expenses are things like housing, food, and utilities that we need to survive. Discretionary expenses are things like entertainment, dining out, and travel that we can live without if necessary. By prioritizing our essential expenses first, we can make sure that we have enough money to cover our basic needs before spending money on non-essential items.

Understanding Your Income and Expenses

As we prioritize our expenses, it is important to have a clear understanding of our income and expenses. This will help us create a budget and determine our essential expenses.

Creating a Budget

To create a budget, we need to know how much money we have coming in and going out each month. We can start by listing all of our sources of income, such as our salary, bonuses, and any other sources of income we may have. Next, we need to list all of our monthly expenses, such as rent/mortgage, utilities, groceries, transportation, and any other expenses we have.

Once we have a clear understanding of our income and expenses, we can start to prioritize our expenses. We can allocate our money towards our essential expenses first, and then allocate the remaining funds towards our other expenses.

Determining Essential Expenses

Determining our essential expenses is crucial when we are on a tight budget. Essential expenses are the expenses that we cannot live without, such as rent/mortgage, utilities, and groceries. We need to make sure we allocate enough money towards our essential expenses before allocating funds towards our other expenses.

It is also important to note that we should always try to live within our means. If our expenses exceed our income, we need to find ways to cut back on our expenses or find ways to increase our income.

By understanding our income and expenses and prioritizing our expenses, we can create a budget that works for us and helps us achieve our financial goals.

Strategies for Prioritizing Expenses like Bills and Debt

When it comes to managing our finances, prioritizing expenses is one of the most important things we can do. This means making sure we pay our bills on time and managing our debt effectively. Here are some strategies to help us prioritize expenses like bills and debt.

Order of Payments

One of the first things we need to do is decide which bills to pay first. We should prioritize bills that are essential for our daily living, such as rent or mortgage payments, utility bills, and food expenses. After that, we can focus on paying off high-interest debt and credit card payments.

It’s important to note that we should always pay at least the minimum payment on our credit cards to avoid late fees and damage to our credit score. If we have multiple credit cards with high balances, we can consider consolidating our debt into one loan with a lower interest rate.

Dealing with High-Interest Debt

High-interest debt, such as credit card debt, can be a major financial burden. To help manage this debt, we can use strategies such as the snowball method or the avalanche method.

The snowball method involves paying off our smallest debts first while making minimum payments on larger debts. Once the smallest debt is paid off, we can use the money we were paying towards that debt to pay off the next smallest debt, and so on. This method can help us build momentum and stay motivated as we see our debts disappear.

The avalanche method involves paying off our debts with the highest interest rates first while making minimum payments on lower interest rate debts. This method can help us save money on interest in the long run.

In conclusion, prioritizing expenses like bills and debt is crucial for our financial well-being. By following these strategies and being disciplined with our spending, we can take control of our finances and work towards a more secure future.

Saving for the Future While Paying Off Debt

When it comes to managing our finances, it can be challenging to balance paying off debt with saving for the future. However, it is essential to prioritize both to ensure financial stability in the long run. In this section, we will discuss the importance of emergency funds and how to balance savings and debt repayment.

Emergency Fund Importance

One of the first steps in saving for the future is to establish an emergency fund. This fund serves as a safety net in case of unexpected expenses, such as medical bills or car repairs. It is recommended to have at least three to six months’ worth of living expenses saved in an emergency fund.

While it may be tempting to put all extra funds towards paying off debt, neglecting an emergency fund can lead to further debt if unexpected expenses arise. Therefore, it is crucial to prioritize building an emergency fund alongside debt repayment.

Balancing Savings and Debt Repayment

Once an emergency fund is established, it is essential to balance savings and debt repayment. While paying off debt should be a priority, it is also necessary to save for future expenses, such as retirement or a down payment on a house.

One approach to balancing savings and debt repayment is to allocate a portion of income towards each goal. For example, we can set a percentage of our income towards debt repayment and another percentage towards savings. This approach ensures progress towards both goals while avoiding neglecting one for the other.

Another approach is to prioritize debt repayment first and then allocate more towards savings once debt is paid off. This approach can provide a sense of accomplishment and motivation to continue towards future savings goals.

In conclusion, saving for the future while paying off debt requires a balance of priorities and a clear plan. Establishing an emergency fund and balancing savings and debt repayment are crucial steps towards financial stability. By prioritizing both, we can work towards a secure financial future.

Cutting Costs and Increasing Income

When it comes to prioritizing expenses, cutting costs and increasing income are two effective ways to make sure we are making the most of our budget. By reducing non-essential spending and exploring additional revenue streams, we can free up money to put towards necessities and other important expenses.

Reducing Non-Essential Spending

One way to cut costs is to take a closer look at our spending habits and identify areas where we can adjust. This might mean creating a budget and sticking to it, making a grocery list and avoiding impulse purchases, or simply being more mindful of our spending overall.

We can also look for ways to reduce our bills and expenses. For example, we might switch to a cheaper phone plan, cancel subscriptions we don’t use, or negotiate with service providers to get a better deal.

Exploring Additional Revenue Streams

In addition to cutting costs, we can also increase our income to help make ends meet. This might mean taking on a side hustle or freelance work, selling items we no longer need, or asking for a raise at our current job.

We can also look for ways to monetize our skills and expertise. For example, we might offer consulting services, teach a class or workshop, or start a blog or podcast.

By cutting costs and increasing our income, we can prioritize our expenses and make sure we are able to cover our necessities while still enjoying the things we love.

Navigating Financial Challenges

When it comes to managing our finances, unexpected expenses and economic downturns can pose significant challenges. However, with careful planning and prioritization, we can navigate these challenges and emerge stronger on the other side.

Handling Unexpected Expenses

One of the most important steps we can take to prepare for unexpected expenses is to establish an emergency savings fund. This fund should ideally cover at least three to six months’ worth of living expenses, and should be easily accessible in case of emergency.

In addition to building an emergency fund, it is also important to consider purchasing insurance to protect against unexpected expenses such as medical bills or home repairs. This can help to mitigate the financial impact of unexpected events and provide peace of mind.

Dealing with Economic Downturns

During times of economic downturn, it is important to be proactive in managing our finances. This may include cutting back on non-essential expenses, finding ways to increase our income, or seeking out government assistance programs if necessary.

It is also important to stay informed about the state of the economy and any potential impacts on our personal finances. This can help us to make informed decisions and take proactive steps to protect our financial well-being.

Overall, while financial challenges can be difficult to navigate, with careful planning and prioritization, we can weather these storms and emerge stronger on the other side.

Frequently Asked Questions

What are the essential spending areas that are often overlooked when budgeting?

When creating a budget, it’s easy to focus on the big-ticket items like rent, utilities, and groceries. However, there are several essential spending areas that are often overlooked. These include:

- Emergency fund: It’s important to set aside money for unexpected expenses, such as car repairs or medical bills.

- Retirement savings: Even if retirement seems far off, it’s important to start saving early to ensure financial stability in the future.

- Debt repayment: If you have outstanding debts, it’s crucial to prioritize paying them off to avoid accruing interest.

Can you provide an example of Priority Based Budgeting?

Priority Based Budgeting is a method of budgeting that involves assigning a priority level to each expense based on its importance. For example, if you have a limited budget, you might assign the highest priority to essential expenses like rent and groceries, followed by discretionary expenses like entertainment and dining out. By prioritizing your expenses in this way, you can ensure that you’re allocating your resources effectively.

What should be the first priority when creating a budget?

The first priority when creating a budget should be to determine your income and fixed expenses. This includes your salary or wages, as well as any recurring expenses like rent, utilities, and insurance. Once you have a clear understanding of your income and fixed expenses, you can begin to allocate your remaining resources to other expenses and savings goals.

How should monthly expenses be evaluated to ensure effective budgeting?

When evaluating monthly expenses, it’s important to consider both fixed and variable expenses. Fixed expenses are recurring expenses that remain the same each month, such as rent or car payments. Variable expenses, on the other hand, can fluctuate from month to month, such as dining out or entertainment. By tracking both fixed and variable expenses, you can identify areas where you might be overspending and adjust your budget accordingly.

How can one determine which expenses should be considered the highest priority?

When determining which expenses should be considered the highest priority, it’s important to consider your personal financial goals and values. For example, if you’re saving for a down payment on a house, you might prioritize expenses related to that goal, such as cutting back on dining out or entertainment. Alternatively, if you’re focused on paying off debt, you might prioritize expenses related to debt repayment. By aligning your expenses with your financial goals, you can ensure that you’re making the most effective use of your resources.

Final Thoughts

And just like that, you’ve danced through the digits and pranced past the pitfalls of financial planning with the elegance of a gazelle in a field of greenbacks. We’ve covered the ins and outs, the ups and downs, and even the occasional merry-go-rounds of prioritizing expenses, transforming what was once a daunting task into a delightful dalliance with your dollars.

As we draw the curtains on this budgeting bonanza, remember that your journey to monetary mastery is a marathon, not a sprint. Take the tips and tricks you’ve gleaned from this guide and wield them like a financial wizard, casting spells of savings and investments that grow faster than a beanstalk on a sunny day in fairytale land.

Don’t let the specter of spending sprees haunt your bank account any longer. Embrace the newfound knowledge and let ‘Prioritizing Expenses’ become your mantra, your battle cry, in the war against wanton wallet wastage. And when in doubt, just think back to the wisdom imparted here, as reliable as a lighthouse guiding ships through foggy financial waters.

We hope you’ve enjoyed this journey as much as we have, and that your pockets feel just a little bit heavier and your heart a tad lighter. Until next time, keep your budget tight, your financial goals in sight, and your spending habits delightfully bright. Here’s to making every penny count, and remember – a well-fed piggy bank makes for a happy home!